Role

Product Designer

Team

Yashodhan Deshmukh, UX Lead

Spandita Jakhar, Product Designer

Oishee Mukherjee, UX Writer

Skills

Visual Design

Interaction Design

Prototyping

Timeline

3 months

Status

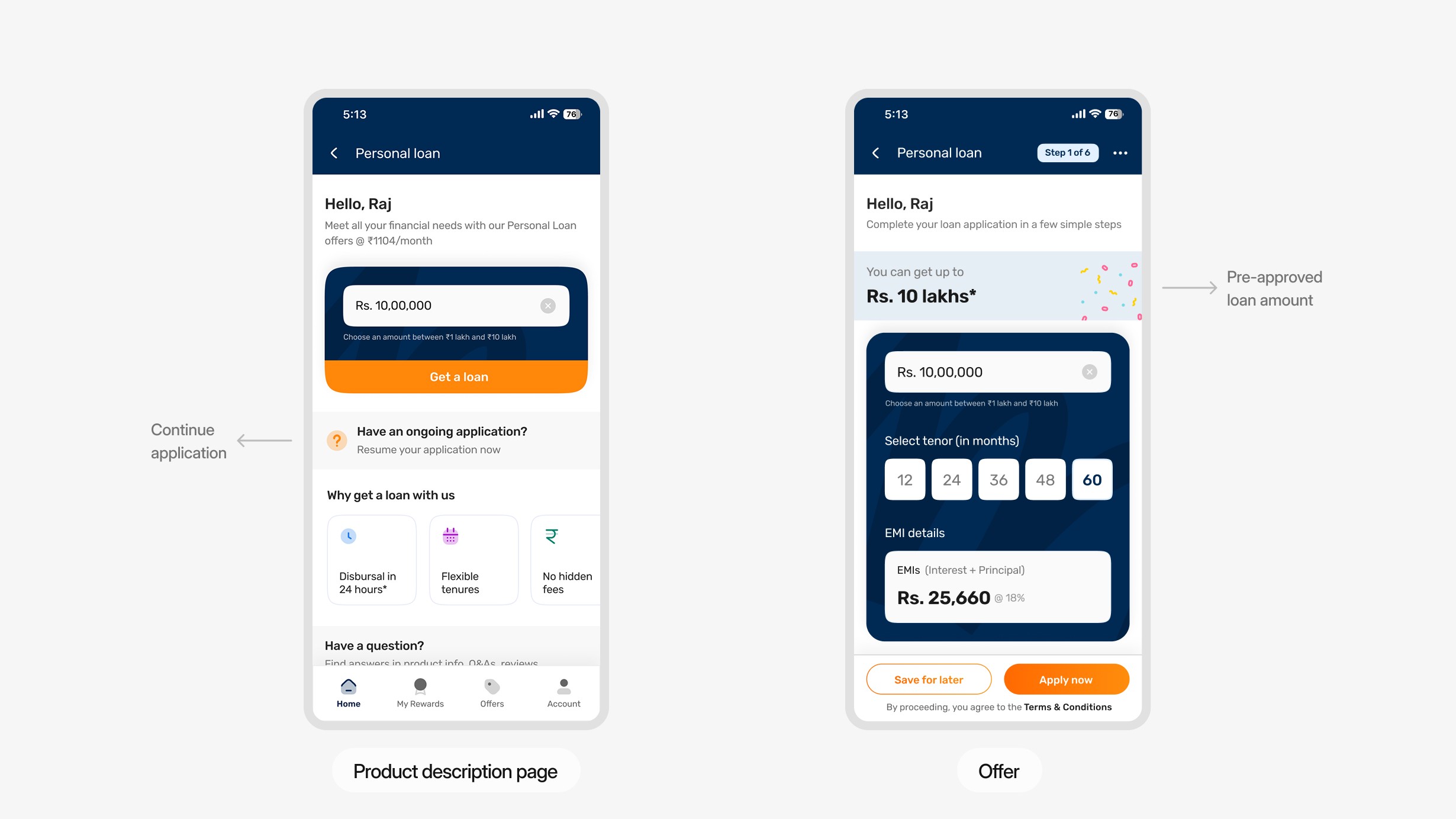

NO PROGRESS CLARITY

Users could not see where they were in the journey or how likely approval was.

OFFLINE STEPS BROKE FLOW

Key steps happened offline, creating friction and inconsistency.

HIGH POST-LEAD DROP-OFF

Borrowers often dropped off after lead submission, leaving revenue unrealized.

COMPETITORS OUTPERFORMED

Competing lenders offered instant eligibility and full digital verification.

User interviews

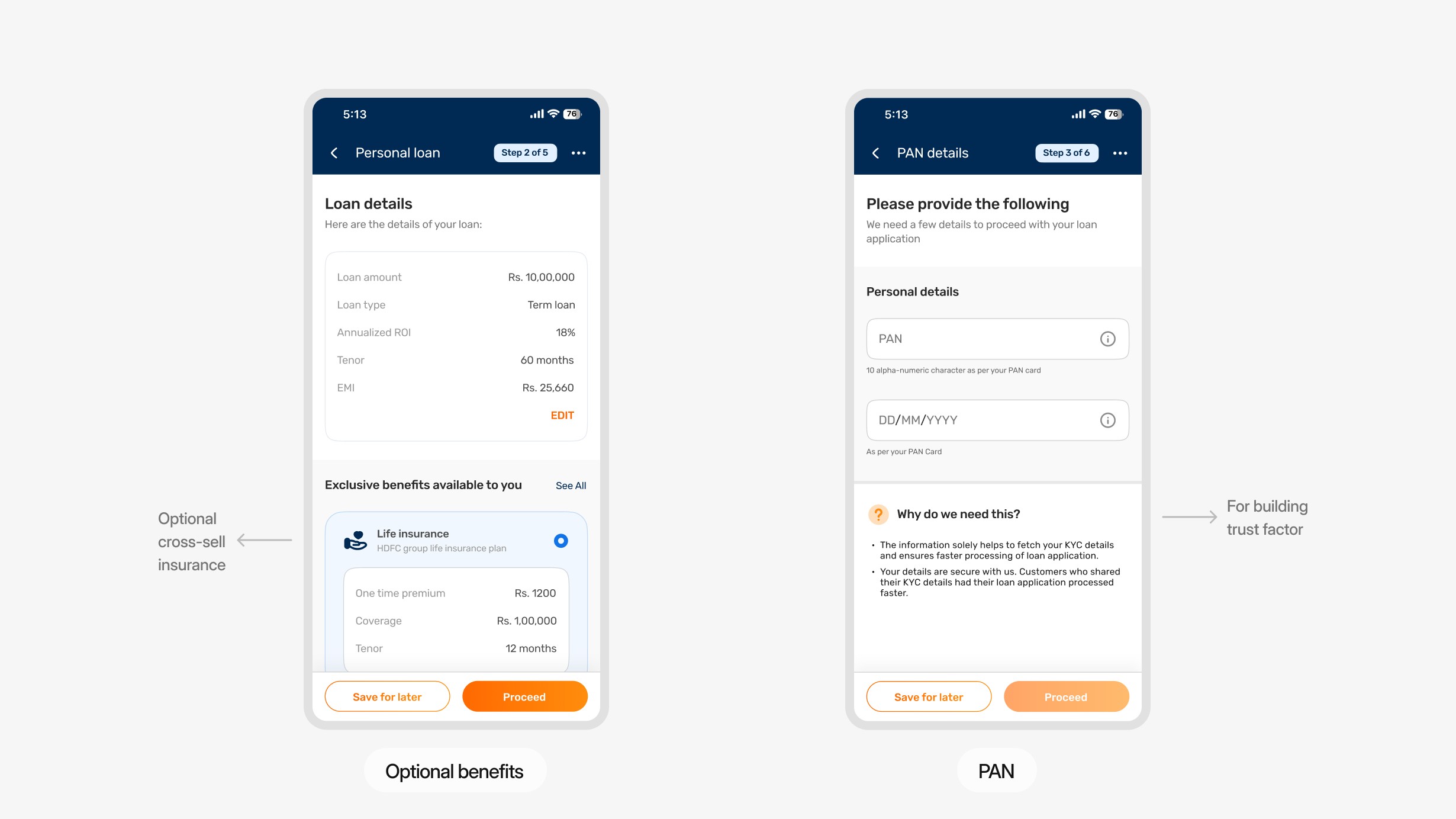

Interviews revealed that users could not see where they stood in the process or what would happen next, creating uncertainty and abandonment.

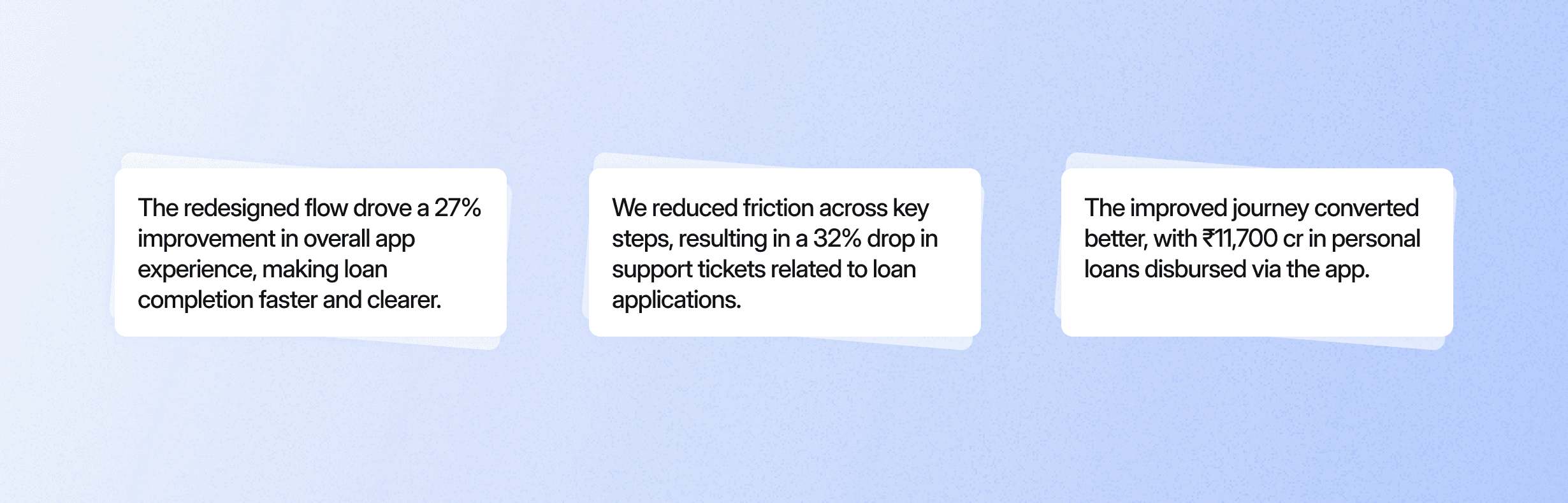

IMPACT

Visibility became a core requirement. Users needed to view status, eligibility, and remaining steps in-app.

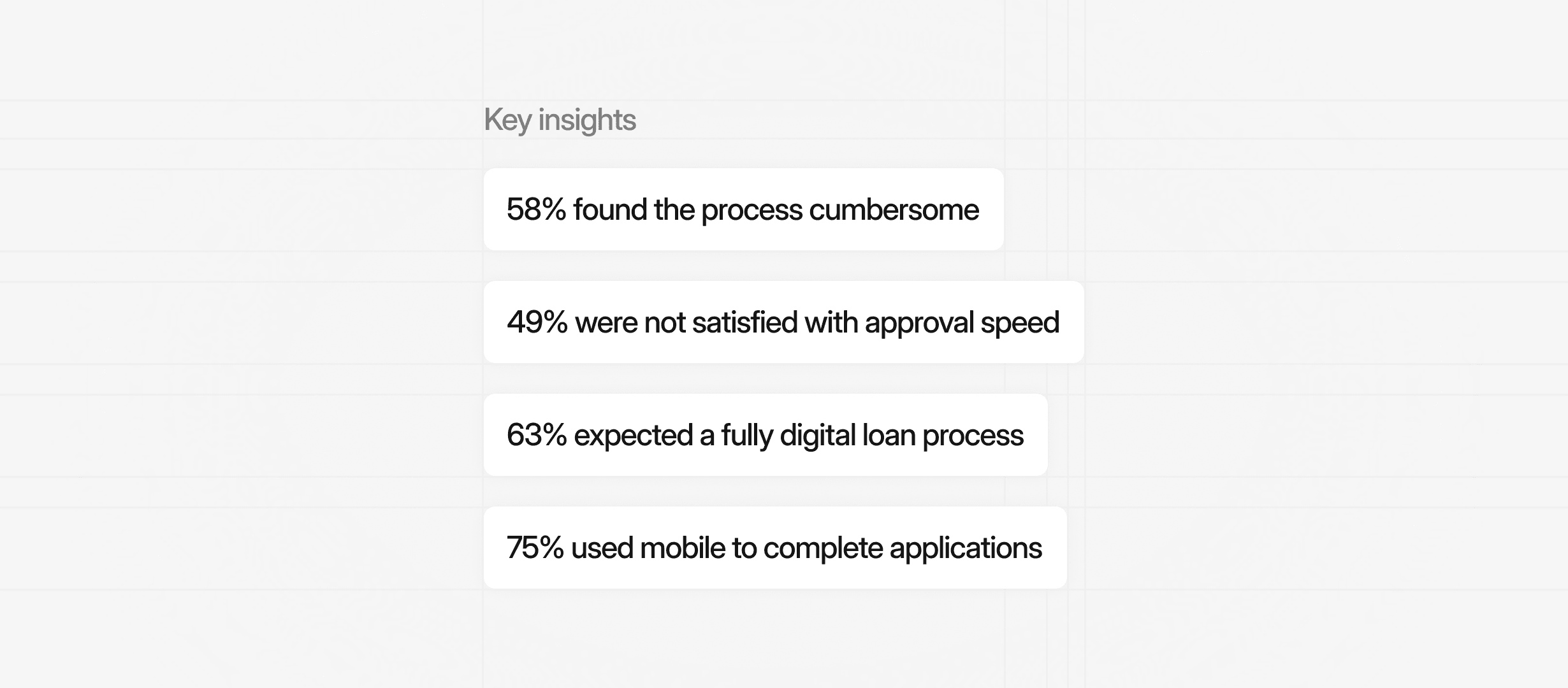

Survey analysis

Survey data showed that slowness and complexity were the top barriers, especially at verification and approval stages.

IMPACT

Speed and simplicity became primary design drivers across the loan journey.

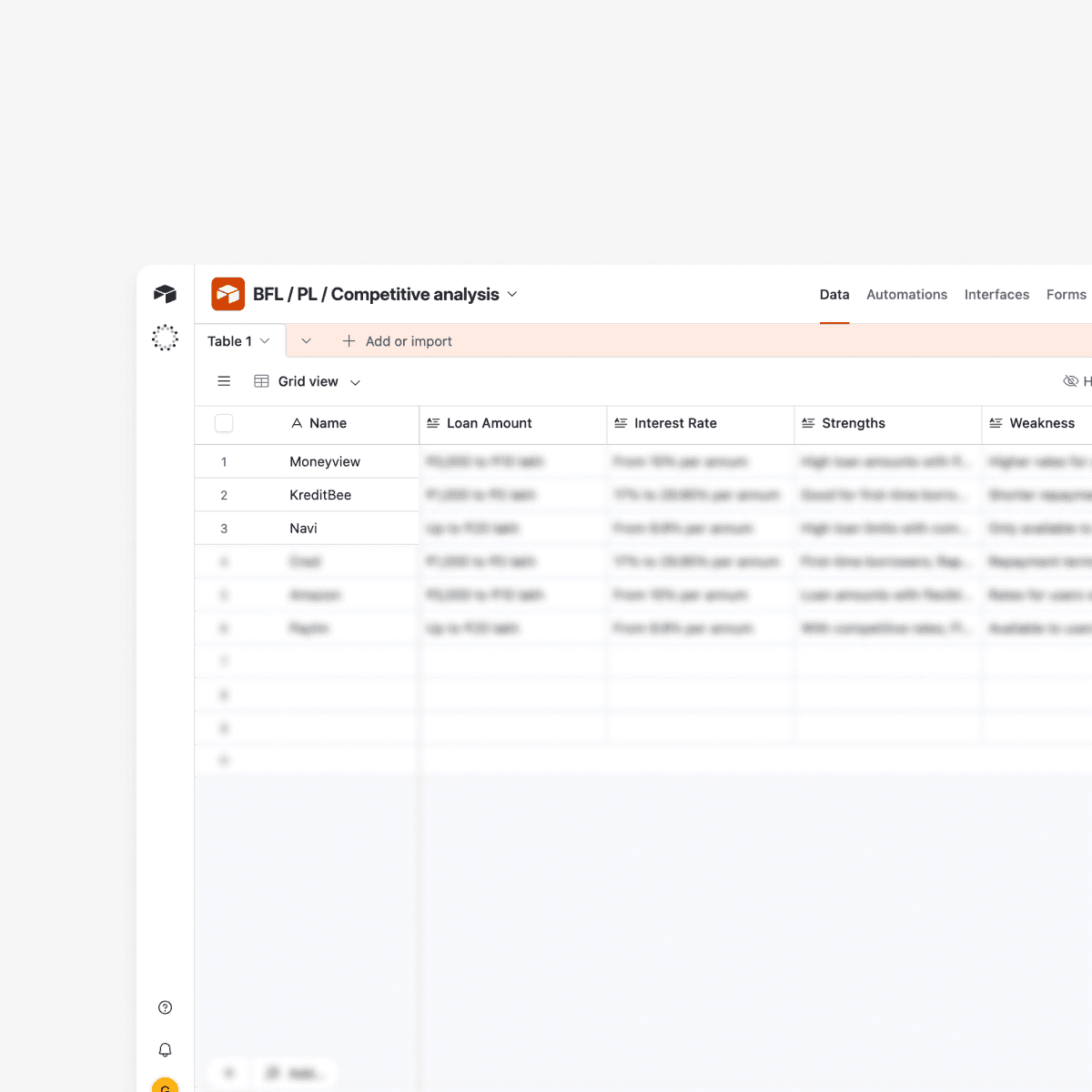

Competitive analysis

Competitors offered instant eligibility and full in-app completion, raising user expectations for a digital-only flow.

IMPACT

We benchmarked end-to-end digital completion as the experience standard.

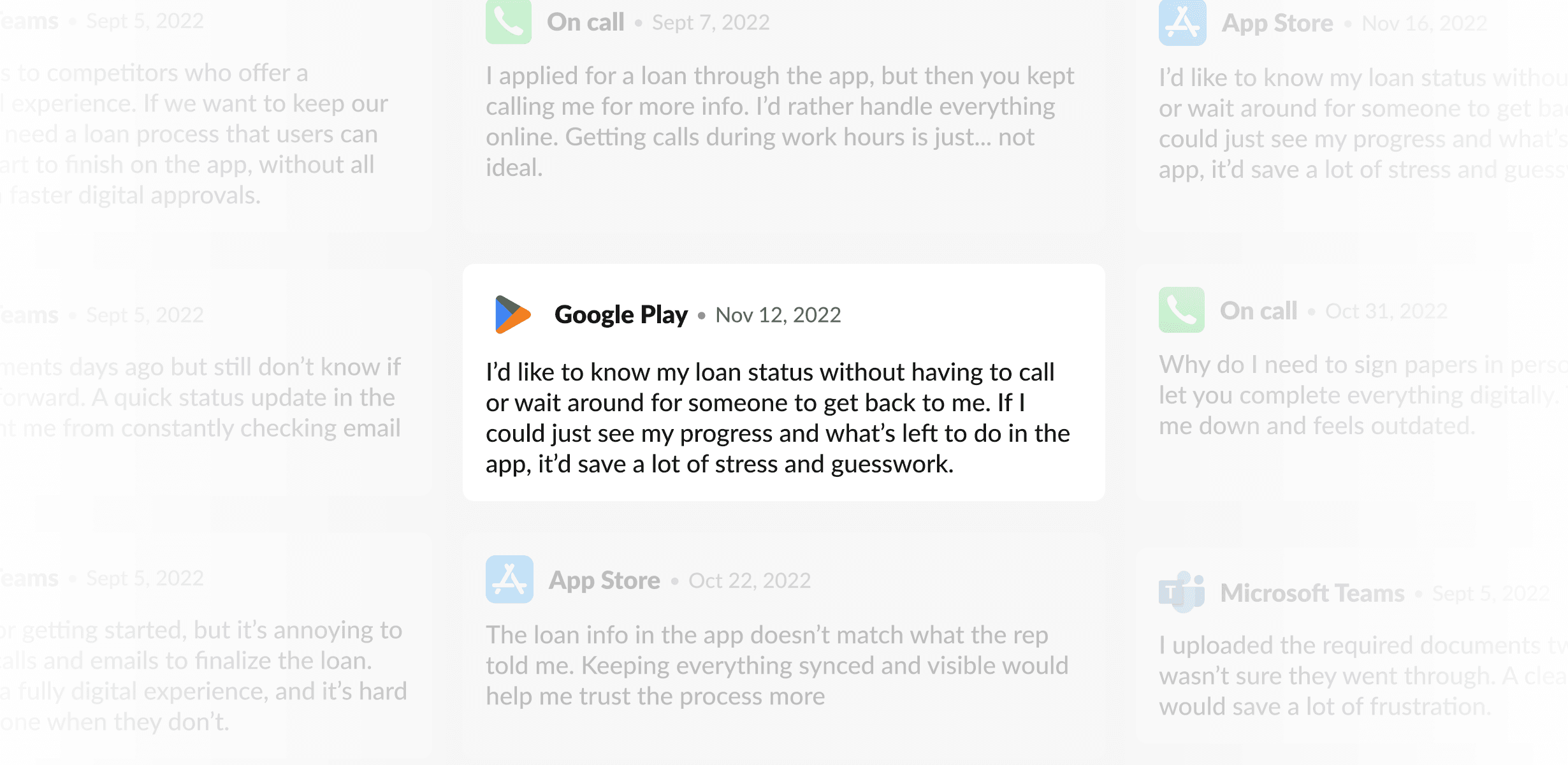

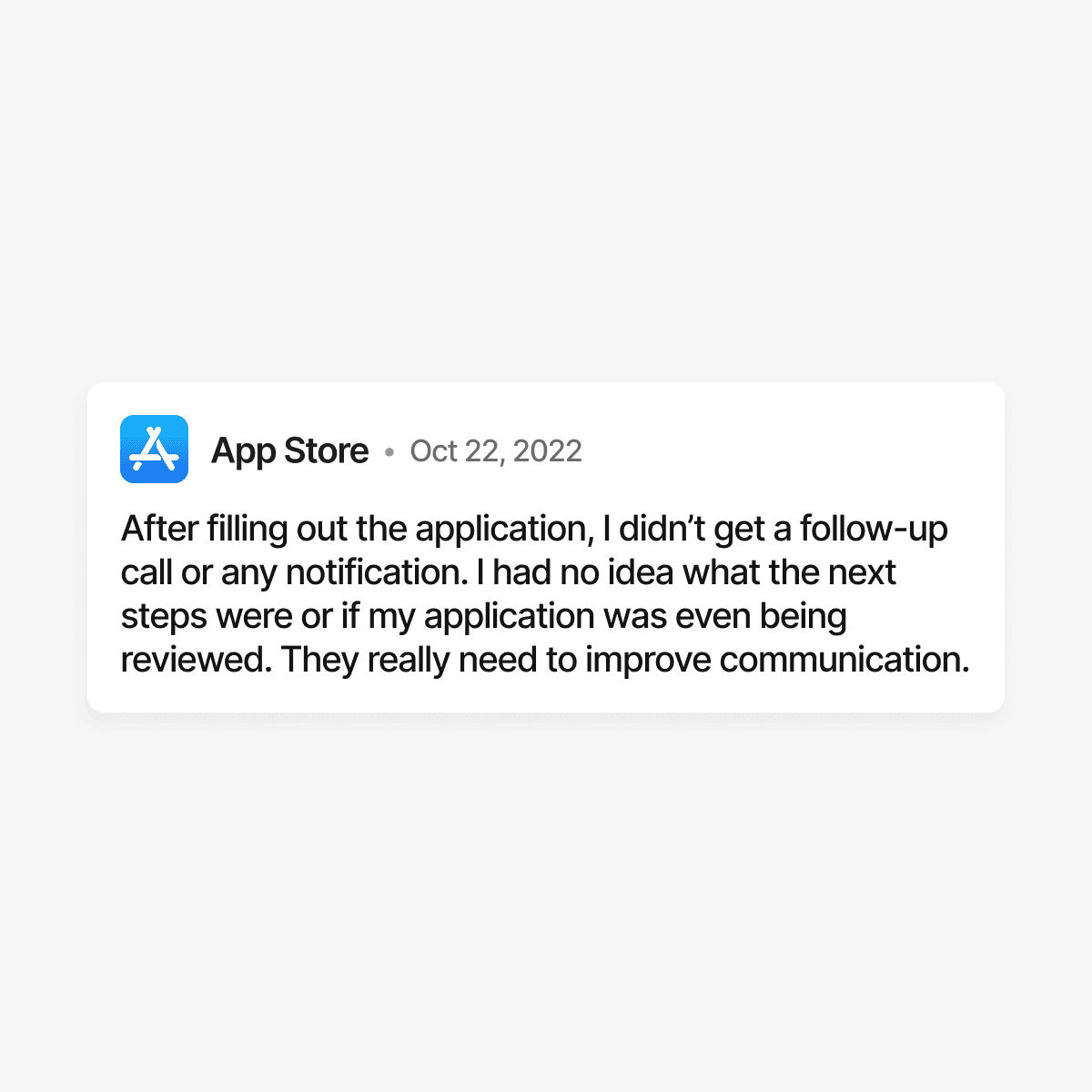

Customer feedback

App reviews and support logs showed users were frustrated by repeated calls, re-entering information, and unclear updates.

IMPACT

Offline dependencies became the top issue to remove in order to reduce drop-offs.

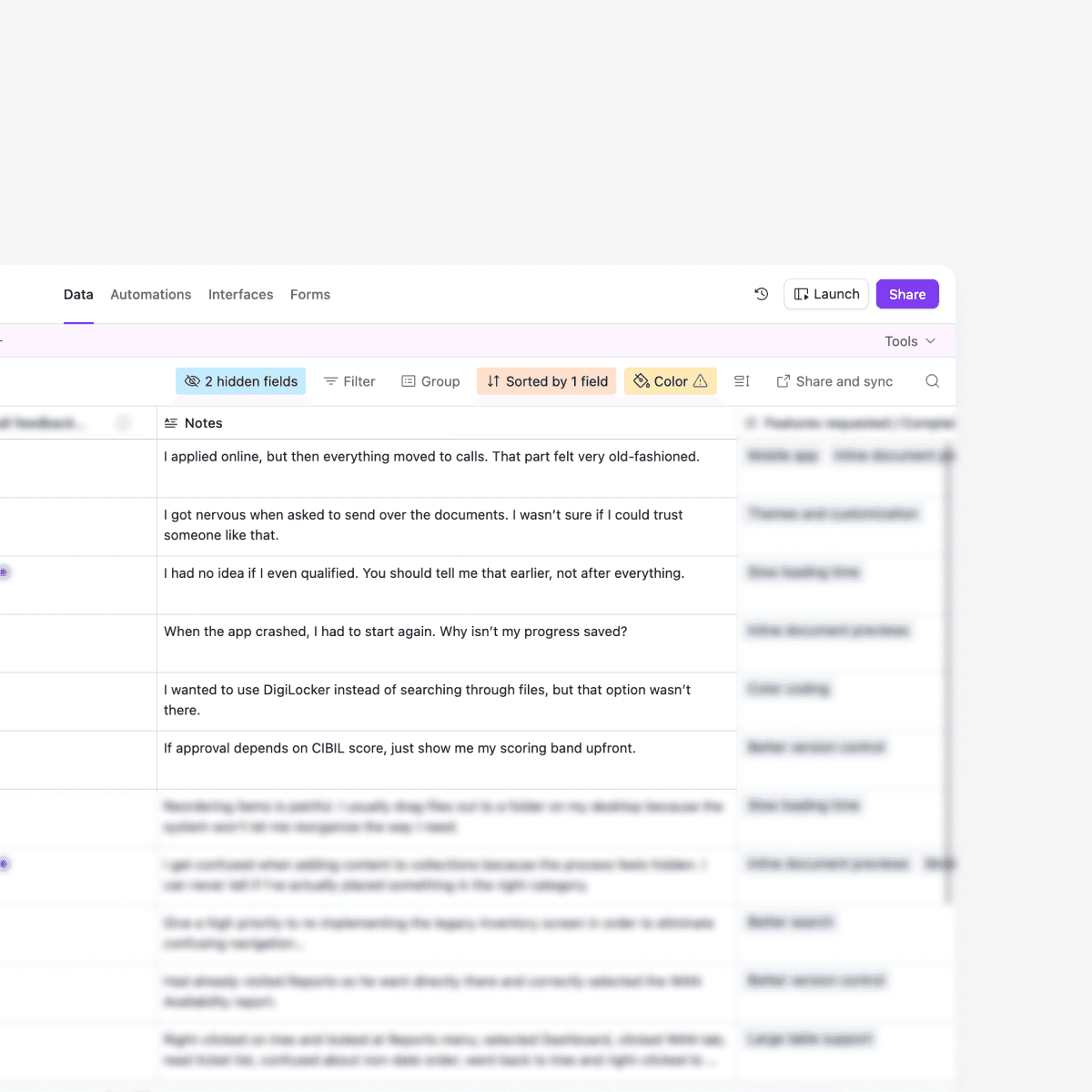

What data revealed at scale

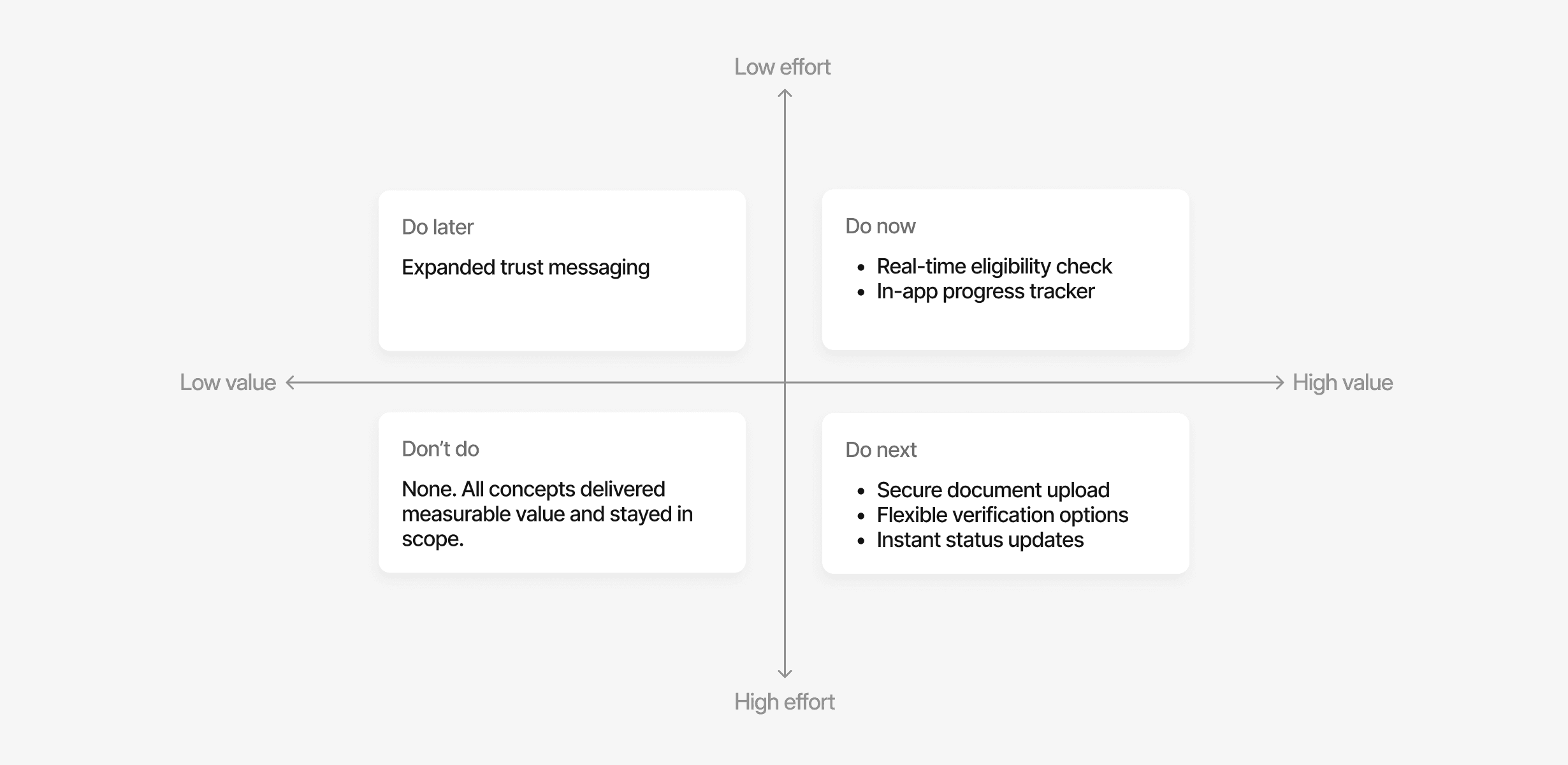

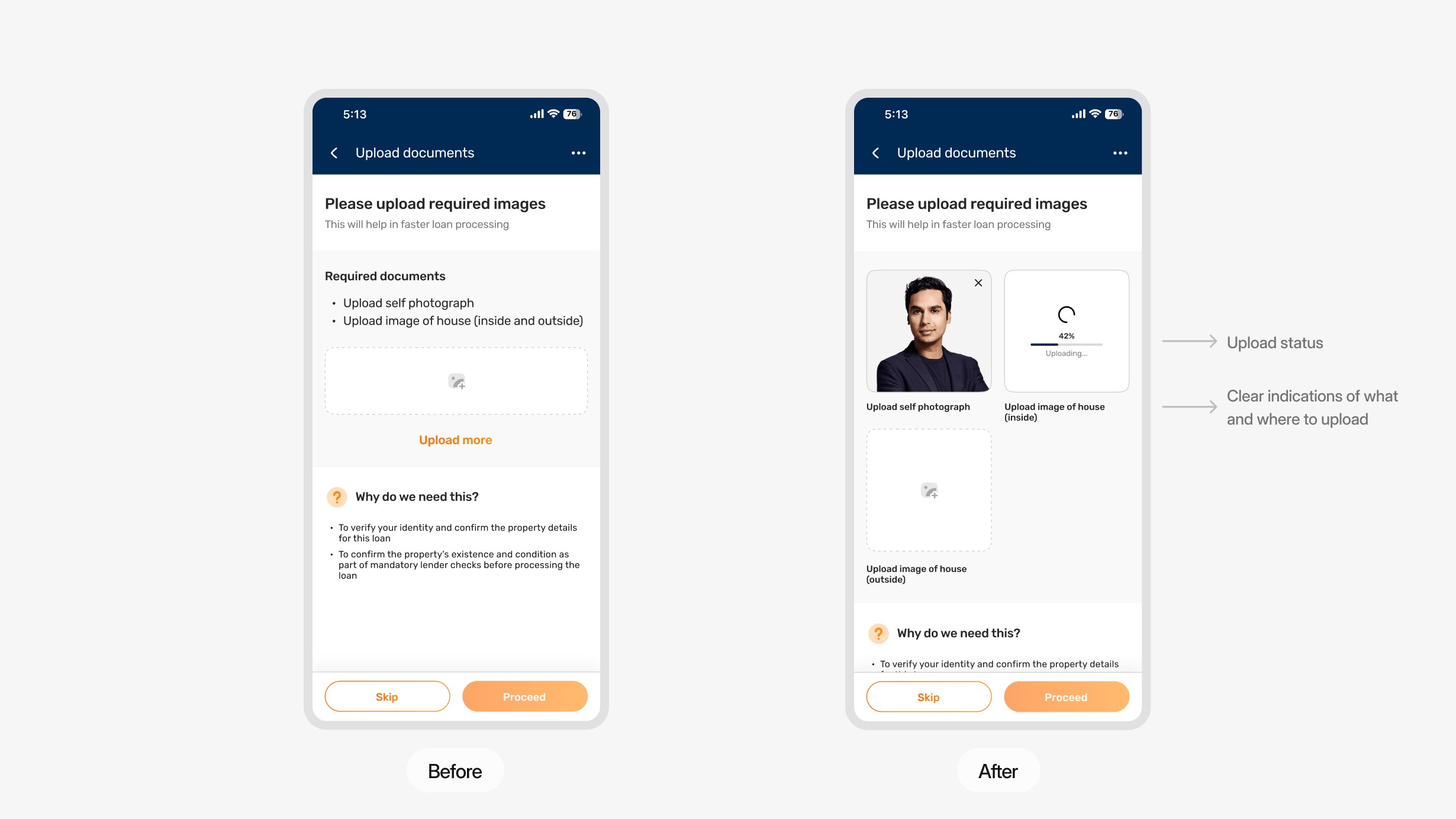

Concept 1: Reduce upload failures

WHY THIS WAS VIABLE

Clear visual prompts reduced confusion and increased successful uploads.

OBSERVED LIMITATIONS

More edge-case handling was needed for retries and multiple uploads.

Reduced upload failure by 30% in testing

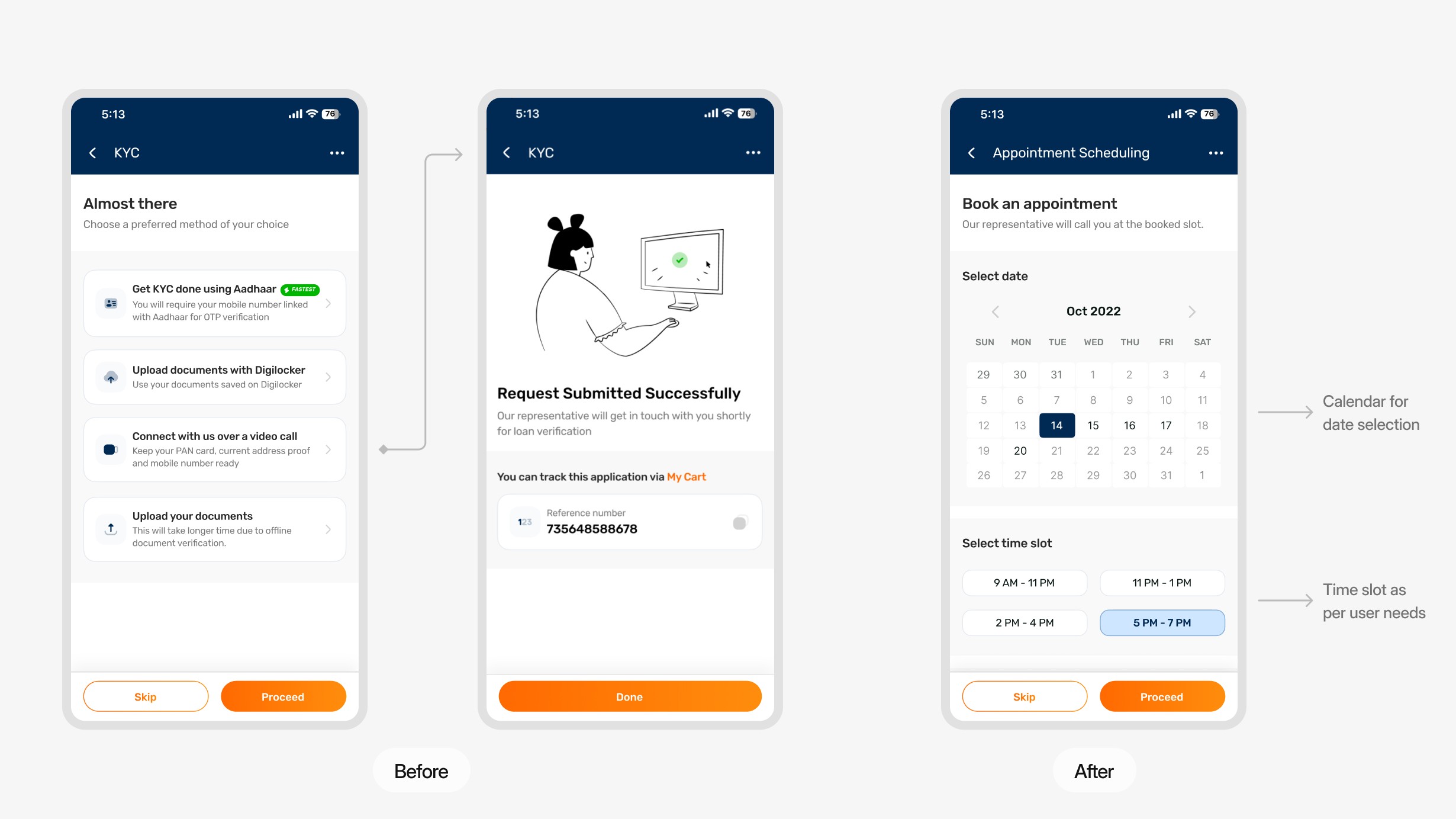

Concept 2: Increase verification completion

WHY THIS WAS VIABLE

Created predictability and reduced anxiety, improving verification completion for users.

OBSERVED LIMITATIONS

Scheduling introduced dependency on operational capacity, requiring coordination with service teams.

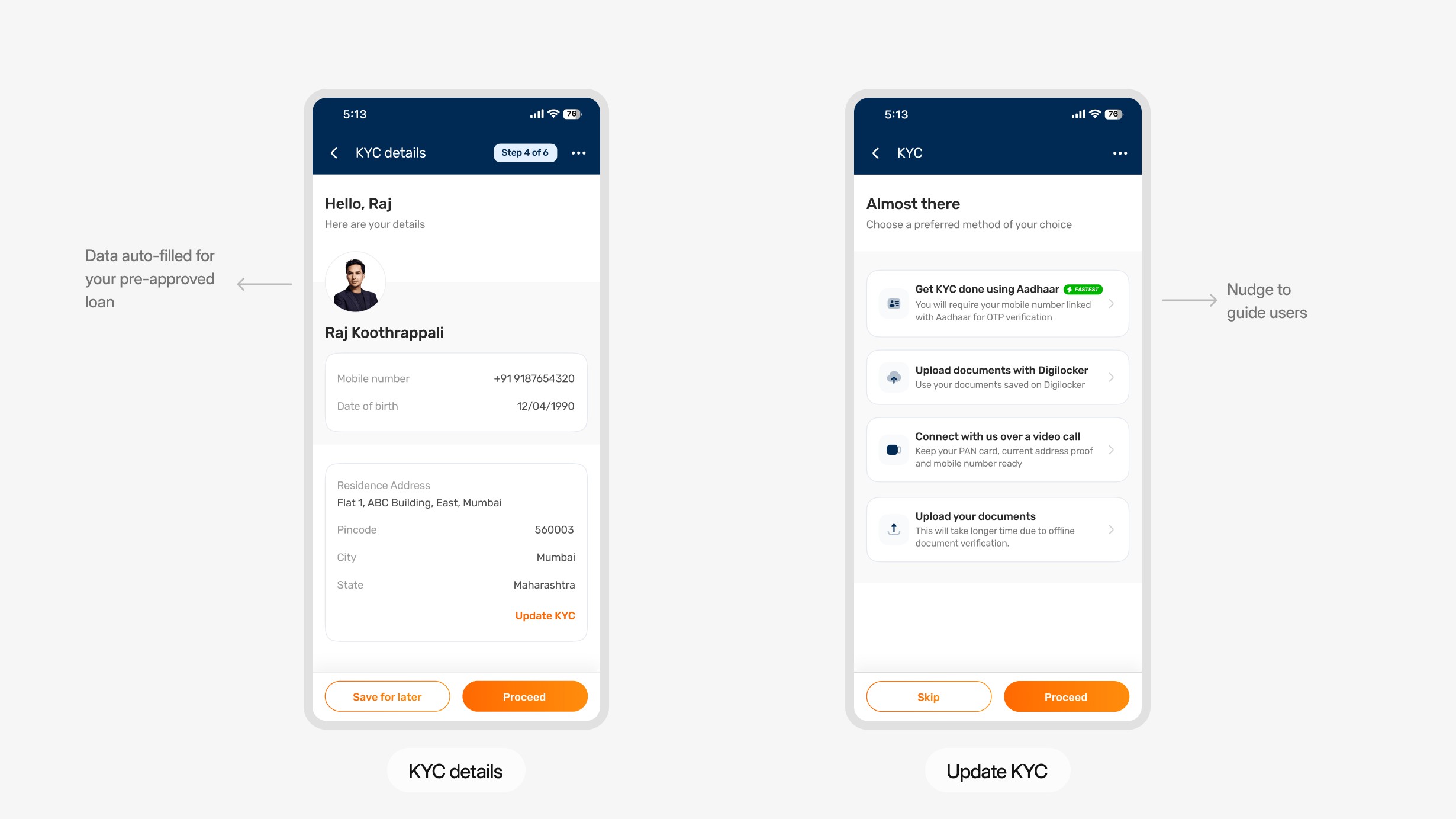

Increased KYC completion rate by 22%

SHARE WORK EARLY

Sharing rough concepts sooner made risk partners more collaborative, and reduced late blockers tied to compliance interpretation.

CURIOSITY UNLOCKS CLARITY

Asking simple questions uncovered hidden assumptions and revealed opportunities that were otherwise ignored or misunderstood.